How To Create a Budget For Your Business: 5 Things To Get Right From The Start

Creating a budget for your business can be an intimidating process, but it’s also essential to the success of your venture. To help you navigate the complexities of preparing a budget, here are five things that will ensure you get off to the right start and why it’s critical that you do so.

From understanding expenses to getting the most out of cash flow forecasting, these tips will help ensure that your business is on solid financial footing from the beginning. So if you want to succeed in business, why not start off on the right foot and read on for our tips for creating your business budget?

Why You Should Create a Budget For a Business

A business budget is much like a personal budget – it helps you keep control over the cash you earn versus the cash you spend. And like any good budget, you set aside certain amounts for different purposes, e.g., expected expenditures on rent or subscription fees as well as unexpected expenses.

By creating a budget for your business, you can easily track your spending on a monthly basis and make informed decisions about how to use the money.

Creating a budget also helps you determine if your business is profitable (or not) by allowing you to compare your actual expenditures against the projected budget.

This will give you an insight into what areas need improvement and what changes you need to make right now to increase your profit. So having an eye on your actuals vs. budget during the month is a great way to make fine adjustments to your business.

Having a budget for your business means that you can plan and create an actionable strategy for achieving your long-term goals from expanding operations or launching a new product line to investing in marketing activities.

What is inside a business budget?

Expected revenue: This includes the money you expect from sales, investments, grants, and other sources.

Expenses: This includes all of your projected costs for things like staffing, supplies and materials, rent or mortgage payments, taxes, utilities, marketing expenses, insurance premiums, and more.

Fixed costs: This is a sub-category of expenses. It contains regularly recurring items such as rent or mortgage payments, loan payments, insurance premiums, and subscription fees.

Variable costs: This is another sub-category of expenses that includes items such as materials (cost of goods sold), supplies, advertising costs, and other variable items.

Savings: This is the portion of your budget that you contribute to savings every month for things like an investment into larger assets (new laptop, a machine you need) and also keep as an emergency fund

Emergency fund: An emergency fund should be part of any business budget. It should include enough money to cover unexpected expenses or unforeseen events that could adversely impact your business.

Investments: This is the portion of your budget you set aside for investing in things like marketing activities, new technology, or other capital projects that can help grow your business.

Actuals vs. budget: You must also compare your actual expenditures against the projected budget. This will give you an insight into what areas need improvement and what changes you need to make right now to increase your profit.

The easiest way to do this is to write your actual income and expenditures right next to the budgeted items for every month. This allows you to create simple actuals vs. budget summaries to tell you at a glance whether your business is on the right track.

A step-by-step guide to business budget planning

Step 1. Select the types of budget for your business

Before you start budget planning, it’s important to decide what type of budget makes the most sense for your business. This will help make sure you are tracking the right information and have an accurate financial plan in place. Different types of budgets include :

Cash flow budget: A cash flow budget looks at all sources of income and expenses, focusing on the amount of money in circulation. If you have a business such as a retail store or restaurant, this type of budget will be most useful.

Profit and loss (P&L) budget: This type of budget focuses on your business’s expected profits and losses over a certain period. It is the most classical budget and probably the first (and sometimes also for a while only) budget businesses make. If you are running an online-only business for example, this is the right budget for you.

Capital expenditure (CAPEX) budget:CAPEX budgets focus on expenses related to long-term investments, such as equipment purchases. It is important for businesses that need to invest in physical assets.

Master budget: A master budget combines elements of other budgets and provides an overall view of your business’s financial situation. It is useful if you want to track the long-term goals of your business, such as expansion projects or a new product launch.

Step 2. Identify income streams and expenses

Once you know what kind of budget you need, the next step is to identify all the income sources you have, as well as your expenses.

This will help you understand where your money is coming from and where it’s going each month. In the beginning, simply list all your income streams, the same as your fixed and regular costs. Then think through the questions below and see if you have forgotten to list anything.

Questions for cross-checking your list:

- Do you expect revenue from online sales?

- Do you expect revenue from offline sales?

- Are all of these one-off or recurring (think subscription)?

- Did you account for all your fixed-cost positions? Rent, insurance, etc.

- Did you list all your variable costs? Marketing, taxes, etc.

- Do you have any other expenses that occur regularly or seasonally?

Step 3. Create a budget spreadsheet

Now it’s time to put all these items into a clean spreadsheet. You can do this in your preferred spreadsheet software from scratch or use templates other people provide. The design does not matter, as long as it works for you. Classical budgets have the items listed in rows, and then each column is a month.

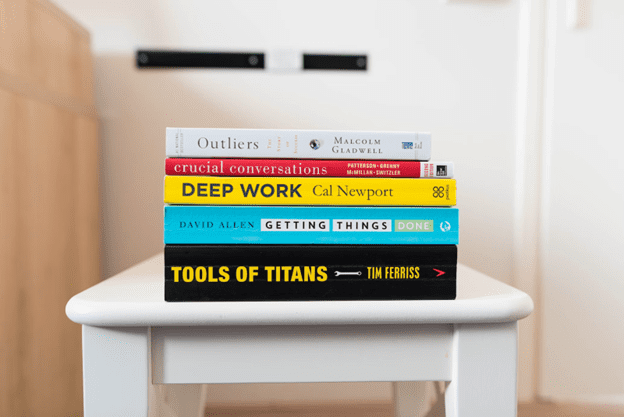

Instead of using spreadsheets, you can also use one of the many popular budgeting tools out there. Some of the most well-known business budget tools include QuickBooks and NetSuite. Both of which have a plethora of business budget template choices.

When it comes to power and features, NetSuite has been consistently viewed as the superior choice. Businesses opt for this software when they need an integrated business management system in addition to a lasting accounting platform. On the other hand, QuickBooks is usually chosen by those who are looking for a straightforward yet affordable financial tool.

Step 4. Calculate projected income and expenses

Whether you choose simple spreadsheets or a professional budgeting tool, now is the time to calculate the budget. Start by entering your expected income and then move on to the expenses.

When calculating the expenses, try to be as detailed as possible – you can use percentages of revenue or fixed amounts for each item. It is also important to think about the worst-case scenario and adjust accordingly. For example, if it’s a slow season in your industry, plan for a lower income this month.

Step 5. Revisit your budget regularly

As time goes by and your business grows, you’ll need to re-evaluate your budget to make sure it still reflects reality. Also, if you have any new projects, these may require additional funding or budget allocation. To make sure that your budget is always up to date, it’s recommended that you review and revise it at least once a month.

5 Things to Get Right From The Start

Those new to budgeting will often follow the above-mentioned steps, without understanding the criticality of certain points (e.g., planning expected and unexpected expenses) versus the less important points (e.g., using a spreadsheet vs. budgeting software). To help you avoid the most common rookie mistakes when it comes to budgeting, here are 5 things to keep in mind so you can make sure that your business budget is set up for success.

1. Understand your expenses

Before you even begin constructing a budget, it’s important that you have an understanding of the different types of expenses that are associated with running a business. Think about all costs, from those related to staff and materials to rent, taxes, and insurance – keeping in mind that some may be more regular than others. If you run an online business, certain expenses might not be relevant for you: rent, electricity, and water. On the other hand, you will likely be subscribing to online services like website hosting, payment provider fees, and others.

2. Get cash flow forecasting right

Cash flow forecasting is an essential part of budgeting, as it helps you predict the future financial health of your business and respond accordingly to avoid any potential pitfalls. Knowing how much money is coming in each month will give you an indication of how much you can spend; similarly, a breakdown of expected expenses will provide you with a better understanding of where your money is going.

3. Know what’s normal and acceptable

When creating a budget, it’s important to bear in mind that certain costs are unavoidable – such as taxes, insurance, and rent payments. Knowing what the average cost for these items should be in your industry will help you to keep your budget in check and make sure you’re not overspending. You can find typical costs for different items by researching other companies in your sector and talking to industry professionals.

4. Look out for unexpected costs

When creating a budget, it’s essential to include some room for unexpected expenses such as repairs or new equipment purchases. It’s important to factor these into your calculation so that you can respond quickly if the need arises.

5. Don’t forget to account for yourself!

Don’t forget to factor in a salary for yourself, as this is one of the most important expenses for any business owner. If possible, try and budget for at least six months’ worth of living costs, so that you can ensure your financial security without having to dip into the business’s coffers.

Creating a budget is an essential part of running any successful business. By following these five tips and adjusting your budget as needed throughout the year, you should be able to keep track of all costs and stay within your desired spending limit

What Does a Budget Cycle Look Like For a Small Business?

Every business follows a budget cycle. This is what it looks like:

Setting the Budget

The first step in the budget cycle is to set a preliminary budget for the upcoming year based on estimated sales, expenses, and other factors.

Ensuring Compliance with Relevant Regulations

Once you have set your budget, it is important to make sure that your business complies with any relevant regulations in your area.

Monitoring Progress Against the Budget

It is important to monitor progress against your budget throughout the year and make necessary adjustments as needed.

Revising and Updating the Budget

As you go along, it’s a good idea to revise and update your budget regularly to reflect changes in sales or expenses.

Finalizing and Approving the Budget

After making any necessary adjustments, you should finalize and approve your budget as it stands. This marks the end of the budget cycle for that year.

Following a budget cycle is an essential part of managing a small business. Doing so can help to ensure that you stay on top of your

Extra Tip: Lowering your fixed costs

Especially when starting a business, you might be concerned about the costs you regularly have to pay. To lower your fixed costs, try to:

- Share resources with other businesses where possible (e.g., renting office space or sharing an accountant)

- Choose the right all-purpose AI tools to help you with various business tasks

- Look into subscription services that offer discounted rates

- Negotiate with suppliers for better rates

- Take advantage of any special discounts or incentives

- Consider using open source software for your business instead of expensive paid-for-business solutions

- Make bulk purchases when possible

- Consider switching over to virtual services where possible (as they are typically cheaper, e.g., a bank without physical branches tends to have lower banking fees)

By reducing your fixed costs, you can better manage your budget and ensure that your business is as efficient as possible. This will help you to stay on top of your financial goals and increase the chances of success for your small business.

About the author

Aaron Yamamoto

Aaron is the founder of jiishinya. where he helps people independent of their gender, background, or education achieve success financially and privately. He is very passionate about creating a secure financial future for himself and his family and as a small business owner, is always on top of his business budget to avoid any unexpected costs.